Czech and Norwegian perspectives on new security threats concerning Russian war on Ukraine - energy security

paper

Russia’s invasion of Ukraine in February 2022 has disrupted the world’s energy system. The most urgent need was to phase out the EU’s dependence on Russian energy imports and find a quick replacement.

In this joint paper, we approach the issue from two different perspectives of the Czech Republic and Norway, looking for intersections and identifying opportunities to strengthen cooperation and facilitate the accelerated energy transition and diversification.

We conclude that both countries have taken immediate action in addressing the most pressing energy-related risks. The potential for closer cooperation is obvious. Both countries should maximise the level of collaboration by taking advantage of existing institutional frameworks (NATO and EU/EEA). In the energy dimension, the key to cooperation in the short term is gas (investment in production in Norway, development of export pipelines or protecting critical sub-sea infrastructure). In the longer term, both countries should jointly cooperate on developing of hydrogen market, including production and transportation.

Introduction

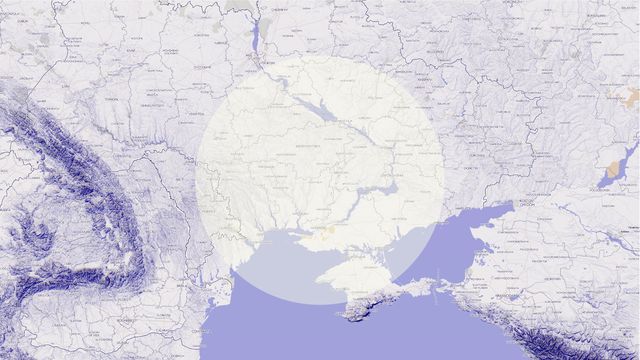

Russia’s military aggression against Ukraine and its weaponisation of energy have provoked an unprecedented energy crisis. Lower levels of gas delivery to the European Union (EU) and increased gas supply disruptions have led to a steep rise in energy prices, volatility and high inflation. This has severely impacted households, and gas-intensive sectors and gas-importing countries have suffered. Russia has proven to be an unreliable partner for energy cooperation, making the EU look for other sources of natural gas. Although the EU and its member states (MS) have been able to handle immediate issues and prepare for the winter season 2022/23 (see more about measures adopted in the next chapter and appendixes 1 and 2), energy markets are far away to be out of the danger as the situation may deteriorate at any moment. This could entail further disruption of Russian flows, global supplies of liquified natural gas (LNG) becoming tighter or harsher weather conditions. Undoubtedly, there is a clearly stated desire to cut off energy supplies from Russia as soon as possible. Such a development would provide some market opportunities to other natural gas suppliers. Norway, which has traditionally played a vital role in the EU gas market, could also benefit from such a situation. However, its ability to fill the gap is narrow due to limited resources and production and transport capacities.

In this joint Czech-Norwegian project, we approach these issues from various angles. We seek to understand who the key stakeholders in these debates are, how questions related to energy security are framed in media, reflected in policy responses, and how policy measures that are proposed as both joint European and individual states’ actions should be implemented. First, from the point of view of the Czech Republic, a country dependent on energy imports from Russia and an industry-based economy with an energy intensity higher than the EU average, the solution to energy security in the short-term is entirely linked to the problem of diversification from Russia. Second, from the point of view of Norway, one of the key producers and exporters of fossil fuels to the EU market and a country with a domestic market dominated by renewable energy resources (RES), the current situation provides some opportunities. However, it needs to be seen in the broader context of the debate on the role of fossil fuels in the EU and global energy mix. Given both countries’ specific natural gas positions, this commodity and its role in energy security will be the main focus. We use the four As a concept of energy security, looking for intersections and identifying opportunities to strengthen energy cooperation.

CHANGING UNDERSTANDING OF ENERGY SECURITY

Energy security refers to the degree of danger associated with a specific way of supplying energy, either concerning the supplier or the fuel supply. The critical concern is how to ensure continuous, uninterrupted, and stable energy supplies at an acceptable price. This consumer-oriented definition is complemented by a producer-oriented view of energy security, which requests the ensuring of a sufficient volume of sales of supplied energy for acceptable prices. However, there are many other working definitions, e.g., Alhajji recommends analysing energy security with regard to six specific aspects, such as economic, environmental, technological, social, foreign policy, and national security. It is also essential to understand how an energy system can be exposed to various security threats and how it can be viewed as a subject generating or enhancing insecurity. This approach is fundamental in light of Russian attacks on elements of energy infrastructure in Ukraine and the possible risk of sabotage against other elements of critical energy infrastructure in Europe as exemplified by the attack on the Nord Stream that has turned out to be difficult to attribute.

However, in this paper, we frame the issue of energy security by the concept of the four As that focus on physical terms and both short-term and longer-term objectives. The four As are availability (as resource availability), accessibility (infrastructure), affordability (prices and competitiveness) and acceptability (as public acceptance, sustainability).

ADDRESSING THE EMERGENCY AT THE EU LEVEL

The Russian invasion of Ukraine resulted in the introduction of heavy economic sanctions (also at the G7 level), including the energy sector and measures protecting the EU economy by improving the security of supply and market functioning. In May 2022, the Commission introduced the REPowerEU Plan. It sets out several measures to rapidly reduce dependence on Russian fossil fuels based on diversification, savings and acceleration of green energy transition. The implementation of the REPowerEU Plan goals has been done via a wide range of distinct policy measures, including targeted amendments of existing legislation in the energy field (the Renewable Energy Directive, the Energy Performance of Buildings Directive, and the Energy Efficiency Directive) and temporary measures via Council Regulations (see their complete list in the Appendix 1) under the Article 122 of the Lisbon Treaty, allowing MS to quickly adopt legislation in the case of a threat to supplies of certain, mainly energy products into the EU. Almost all these measures were negotiated during the Czech Republic Presidency of the Council of the EU (CZ PRES).

NORWEGIAN AND CZECH RESPONSES TO ENERGY EMERGENCY IN EUROPE

Over the past three years, there were two major factors influencing international trade in energy commodities, including Norway’s position on the European energy market – the Covid pandemic that reduced global energy demand ????LINK and the outbreak of the war in Ukraine. The latter was undoubtedly the main external shock influencing energy markets. Until the outbreak of the war, the Czech Republic was, due to its geographical proximity and interconnections, almost entirely dependent on Russian pipeline gas supplies. In contrast, Norway had been the second most crucial external supplier of gas to the EU, next to Russia. Due to the existing infrastructure linking Norwegian gas and oil fields with European customers, almost whole Norwegian production reaches the EU market. However, due to the gradual elimination of Russian gas supplies to the EU, the EU’s restrictive measures and Russia’s countermoves, the lower gas demand and demand destruction in the industry due to high prices and saving measures Norway has increased its share of the EU gas market. As of the first quarter of 2023, EU dependence on Russian gas decreased to 10%. Consequently, no Russian pipeline gas reached the Czech Republic as all imported gas flowed through Germany, consisting primarily of LNG from Belgium and the Netherlands and gas from Norway.

THE NORWEGIAN RESPONSES

Energy cooperation and competition are no longer viewed in Norway as a purely economic matter as energy supplies from Norway to Europe are also to help Norway’s NATO allies and EU partners deal with a serious security challenge. Energy cooperation with Russia that had tried to weaponise its energy supplies to influence EU policies towards the war in Ukraine has been securitised, meaning no longer viewed as an economic issue. Access to alternative energy sources became crucial, and Norway’s role as an increasingly indispensable energy supplier to Europe became even more apparent.

Being the second most important external supplier of gas and oil to the EU, with which Norway is firmly integrated through the European Economic Area framework and NATO ally of its most important actual and potential energy customers, Norway took various steps to address energy-related challenges faced by its partners. On 23 June 2022, a joint EU-Norway statement on strengthening energy cooperation was presented in Brussels. Norway and the EU agreed to step up cooperation to ensure additional short-term and long-term gas supplies from Norway, to address the issue of high energy prices, and to develop long-term cooperation and partnership on offshore RES, hydrogen, carbon capture and storage (CCS), and energy research and development. Although it was recognised that supplies of fossil fuels from Norway alone could not completely replace supplies of fossil fuels from Russia, Norway could help the EU address the most acute problem – the expected gas shortage on the EU market in the first months after the Russian invasion. The Norwegian energy rescue operation was to help the EU alleviate some of the acute problems caused by Russia’s attempt at using energy as a weapon to achieve its strategic objectives in Ukraine, Europe and on the global stage. Gas export – almost all of which went to the EU and the United Kingdom – reached 117.7 billion cubic meters (bcm) in 2022, and a 3,3% year-on-year increase. This was the second-highest volume of Norwegian gas exports in history compared to the record year 2017.

Obviously, gas is and will remain the primary Norwegian energy resource for many years to come. Norway will retain its crucial position as the major gas supplier on the European market and will play an essential part in helping the EU survive the coming 2023/2024 Winter. However, it is widely accepted that Norway will not be able to increase the production level, substantially increasing its export in mid- and long-term perspective. It means that the same volume of Norwegian gas that is expected to reach the EU gas market

will have to be ‘shared’ by a higher number of EU MS. The opening of the Baltic Pipe can, for instance, result in the cannibalisation of gas supplies to Germany, posing some political challenges to the Norwegian decision makers.

THE CZECH RESPONSES

The Ministry of Industry and Trade (MIT) is a crucial actor whose proposals and implementation respond to the need to ensure sufficient energy supply and maintain an acceptable price level for end consumers. In the second half of 2022, the Czech Republic held CZ PRES, and MIT became an important mediator in resolving the energy crisis also at the EU level. Apart from two regular, CZ PRES also convened five extraordinary meetings of the Energy Council. Besides, CZ PRES also managed to harmonise the often very distinct positions of EU MS and negotiated the adoption of essential emergency measures (see their list in Appendix 1). CZ PRES also contributed to achieving consensus on many of the legislative files from the Fit for 55 package, e.g., a general approach was reached on the proposal for the Energy Performance of Buildings Directive, the Regulation on methane emissions reduction in the energy sector, the Energy Efficiency Directive.

In 2022, MIT also proposed five amendments to the Energy Act and two governmental decrees. They aimed at issues of the highest urgency, namely, losing unused gas storage capacity (the so-called UIOLI principle), mitigating high energy costs via savings tariff and the price cap, and simplifying of permitting process of RES production facilities (see their list in Appendix 2). Besides, it also opened the discussion about constructing the Stork II gas pipeline project using funds from the REPowerEU programme. In addition, CEZ Group, of which the Czech Republic is a significant owner (70 %), booked three bcm of capacity in the floating LNG terminal in Eemshaven in 2022. The booked capacity at Eemshaven is close to covering about a third of the yearly gas demand in the Czech Republic.

LONG TERM RESPONSES

However, dealing with the short-term energy challenges was only the first step to be taken. Norway and the Czech Republic could play a part in addressing other energy security-related challenges in the mid- and long-term perspective.

In the long-term, Norway may become a vital hydrogen player. In January 2023, an agreement was signed between Norwegian and German companies outlining this possibility. Norway’s RES could produce green hydrogen in times of surplus that could be exported via the repurposed existing pipeline network helping the EU deal with energy supplies and decarbonisation and meet the EU’s 2030 hydrogen targets (10 mt of imported hydrogen from RES). In addition, hydrogen could be produced from gas (with CCS) and help to kickstart the hydrogen economy at the early stages of development. However, many factors may influence the development of hydrogen production in Norway, and for the time being, there is much uncertainty about these ambitious plans. The Czech Republic, due to its geographical location and well-developed gas infrastructure and interconnections with neighbouring countries, might step up as an essential hydrogen transit country and help supply hydrogen from its production locations, including Norway, to demand clusters.

Besides, some argue that Norway could contribute to European energy security by becoming Europe’s green battery. However, Norway is expected to need more electricity itself to meet increased power demand caused by higher electrification in transport and industry which makes these plans rather unrealistic. The electricity export issue has also become an issue in Norwegian politics due to high electricity prices. In 2022, the question of energy affordability dominated the public debate, and the government had to introduce several measures, including energy price subsidies to address this problem.

FRAMING ENERGY-RELATED ISSUES IN THE CZECH AND NORWEGIAN MEDIA

Next to the political response, the impact of the war in Ukraine on energy situation is also an issue discussed in national media. In both cases, we analysed the most popular online and print media outlets on how they cover energy security issues (4 As).1 In the case of the Czech Republic, we conducted a qualitative discourse analysis. In the case of Norway, we conducted a quantitative examination of the content of the Norwegian media using 20 key terms to map the energy security-related topics from 2019 – the last pre-Covid year and until 2022 (see results in Appendix 3). These data were used in two ways. First, we mapped which topics received the most attention between 2019 and 2022. Second, we examined which topics emerged as dominant in 2022 by comparing them with the previous years. Results show that all urgent energy-related priorities covered by media were also addressed in respective emergency policy measures. The policy responses to these issues did not significantly lag behind, as both countries have taken quick action to develop, propose and adopt policies shielding their citizens from the most pressing risks (compare with the list of policy measures in Appendixes 1 and 2).

FRAMING ENERGY-RELATED ISSUES IN THE CZECH REPUBLIC MEDIA

Availability and accessibility

The media mainly pointed to the problem of filling underground gas storages (UGS) for the following winter. Filling up will be expensive and logistically challenging – but it will change the energy map of Europe for years to come. iDnes reports that Europe will survive the winter of 2022/23 as UGS have been full, but much of the pumped volume still comes from Russia. Without Russian gas, refilling UGS before the following heating season will be challenging. Despite all the efforts, experts say it is clear that Russian gas will not be entirely replaced in the next few years by other suppliers. According to Hospodářské noviny, the situation can be solved by newly built German LNG terminals (three of them are already operational), the start-up of decommissioned French nuclear power plants and tens of thousands of small solar power plants, whose boom was kick-started by tight energy markets. iDnes also discusses the possibility of replacing Russian gas with LNG.

However, it adds that LNG supplies from Qatar, Norway and the US are not a final solution due to the high prices of LNG, reliability (it mentions frequent strikes in the Norwegian energy sector), lack of LNG terminals and existing suppliers’ contracts with other customers. The speed with which LNG import terminals are being built shows that Europe will probably be able to cope with replacing the Russian gas more quickly than expected. However, LNG in the EU may face infrastructure constraints, as the fossil fuel projects have been underinvested. Journal Ekho (“Echo” in Czech) also considers that Europe will face an energy crisis for years. It confirms that most European and Czech experts agree that UGS could be filled only to 65% of the full capacities before the next heating season. Experts also warn that Russian gas supplied through pipelines to Europe will fall to negligible levels next year, leading to an enormous gap to fill. Such warnings confront European politicians with a disturbing reality, as they have already spent hundreds of billions of euros to ensure that UGS are filled, support households and businesses, and now it looks pretty likely that the burden on public funds and households and businesses will continue next year. Economy-oriented newspaper E15 also notes that the next heating season could be even more demanding because, in addition to the problems of replacing Russian natural gas, the world will also have to focus on the problems of the hypothetic global oil shortage, which may be a big issue in the coming year due to Western embargo on the Russian oil.

Affordability

One of the main concerns is energy affordability, with the government being criticised for losing the battle against skyrocketing energy prices. According to Hospodářské noviny, the incumbent government did not envisage the gravity of the situation or the fact that energy would be expensive for at least another two years. The unprecedented price hikes have significantly shifted the views of representatives of the governing coalition on how the energy crisis should be addressed. Except for pointing out such putative inconsistencies in government policies, other media outputs notice that experts do not expect a sharp rise in prices and generally bet on a gradual decline and stabilisation of the markets. However, they agree that it depends on the coincidence of several favourable circumstances, such as warm weather, gas availability (through finished LNG terminals) and the commissioning of French nuclear power plants.

However, even if favourable conditions eventually materialise, analysts do not expect a return to the prices to which Europe has been accustomed for years. Czech journal Reflex admits that the year 2023 started very optimistically when it comes to gas prices as a continuation of a trend that has been going on for several weeks. It is considerably less than the price cap for Czech households. Slight optimism and a favourable longer-term outlook are expressed. In line with other media outlets, Reflex admits that we will never get back to the low prices of previous years, but the price excesses of the end of the last summer in 2022 will not happen again either.

Acceptability

Media in the sector of RES strongly criticises Czech energy policy. The media points out that the Czech Republic is lagging in building photovoltaic and wind power plants, renovations, and energy-saving measures in buildings. However, according to three electricity distribution system operators (ČEZ, EG.D and PRE), the Czech Republic stays on the verge of another solar boom as they recorded a rapid increase in demand for photovoltaics in 2022. They announced that the number of new applications submitted accounts for roughly 18 GW of installed capacity. Hospodářské noviny claims that the government is trying to catch up; however, RES experts say it is still not doing enough and should accelerate further its efforts as various legislative changes are needed. Meanwhile, MIT proposed two amendments to the Energy Act (see the so-called lex OZE I and II) that should simplify the permitting process and bureaucracy of RES (see Appendix 2).

Norwegian Energy Policy in the Czech Media

The role of Norway as an energy supplier was sometimes discussed in the Czech media. iDnes says that Norway earned huge profits from selling gas for very high prices and has to decide on how to spend this extra revenue without alienating European energy partners and frustrating Norwegian citizens who also experienced an energy price shock in 2022. Former Equinor’s CEO Peter Mellbye, in an interview for a Czech Radio broadcast, says that there is a major political issue in Norway on whether to suspend electricity exports to Europe or to be more solidary. However, Norway is considered as a proper replacement for one-fifth of Russia’s oil supplies to Europe.

FRAMING ENERGY-RELATED ISSUES IN NORWEGIAN MEDIA

The situation in Norway could be described as paradoxical. Being one of the key producers and exporters of fossil fuels and a country endowed with gigantic RES, Norway faced a completely different set of problems than the Czech Republic. The analysis of Norwegian media shows that questions related to high electricity prices in Norway – and indirectly to availability, accessibility and affordability – dominated in 2022. However, when comparing shares in 2022 with shares in the previous years, we noticed that in addition to questions

related to high electricity prices that dominated in 2022 also other questions like energy security in general and in the European context as well as questions related to critical infrastructure and its protection appeared relatively high on the media agenda in 2022 compared with the previous years (for more details see Appendix 3).

Availability, accessibility, and affordability conundrum 2022

One of the issues hotly discussed was the availability, accessibility, and affordability of energy resources, with particular attention paid to differences in access to sufficient electricity supply in various parts of Norway. This lack of access to a sufficient supply of electricity resulted in substantial price differences, directly affecting electricity bills paid by people in various parts of the country. In the pre-war years, electricity prices were relatively low in Norway compared with other European countries and the question of energy affordability was hardly mentioned in the public debate. However, in 2022 the situation was extraordinary as people living in the southern part of Norway had to pay sometimes almost 2000% higher prices for electricity than those living in the northern part of the country.

This issue received much attention in the media and forced policymakers to introduce special measures to alleviate this problem. One of the touchy questions was that this problem was at least partly blamed on the fact that Norway decided to join the European Union Agency for the Cooperation of Energy Regulators (ACER) and built several power interconnectors linking Norway more directly with the European power market and making the country more exposed to energy-related developments on the continent, including swinging electricity prices.

Acceptability

The key acceptability issue discussed in media and the public debate in 2022 was whether Norway should continue exploring and exploiting existing and possibly new oil and gas fields in a situation when the EU, the main energy customer, had to find new supplies to replace the Russian ones. The critical question was whether Norway should help the EU to deal with the short- and mid-term problem of shortage of fossil fuels by increasing the level of production to be supplied to the EU or to reduce the level of production and stop searching for new resources to address the long-term challenge related to climate change and harmful effects of the use of fossil fuels.

Another energy acceptability-related issue discussed in media in this period was how to spend extra revenues earned by the country’s energy sector in 2022. While helping its European partners to address the most burning energy questions in 2022, Norway could also reap substantial economic benefits from its sales. Gas export revenues skyrocketed to 1357 milliard NOK (ca USD 130 billion), almost three times higher than in the previous year – and more than ten times higher than in the Covid year 2020. Oil export revenues reached

less impressive 548.7 milliard NOK (ca USD 54 billion) and were slightly higher than in 2021. Various voices were proposing various solutions to this energy-related abundance dilemma.

Some called for spending a substantial part of the extra revenue on helping Ukraine oppose Russian aggression or in the post-war reconstruction phase. The Norwegian government responded to these calls by earmarking NOK 75 milliard for this purpose. There were also calls to spend some of this revenue to help other countries deal with the question of energy affordability by creating funds to support the energy transition in the less developed parts of the world. Finally, some meant that this extra revenue should be channelled to the Norwegian Government Pension Fund Global to secure the future of the Norwegian welfare

system.

POLICY RECOMMENDATIONS

→ Being members of NATO and having strong connections to the EU – Czechia as MS and Norway through its European Economic Area affiliation and as a key energy supplier, both countries should use these institutional frameworks to increase the level of coordination of their energy policies and to influence the energy policies of other actors shaping the EU energy market and dealing with the questions related to broadly understood energy security within NATO.

→ Over the past decades, and especially after the Russian intervention in Ukraine in 2014, NATO and the EU embarked on closer cooperation signing three agreements on cooperation and coordination of their policies.2 Therefore, both Czechia and Norway should use this institutional framework to promote their energy securityrelated interests as consumers, producers, and exporters of energy, e.g., they should jointly work on protecting critical sub-sea infrastructure, including gas pipelines, powerlines, communication cables and offshore wind farms.

→ However, due to the specific features of NATO and the EU and the evident complementarity of the two organisations’ approaches to these questions, the Czech and the Norwegian policymakers should factor these questions into their approaches to cooperation with both NATO and the EU.

→ Besides, the fact that the newly elected Czech president, Petr Pavel and the former prime minister of Norway and now Secretary General of NATO, Jens Stoltenberg, worked closely together in NATO between 2014 and 2018 should be a factor facilitating the Czech-Norwegian cooperation, both in the bilateral and multilateral context.

→ Regarding energy supplies, Norway has been producing at close to maximum levels and operating its pipelines to the EU and UK close to effective full daily capacity. Therefore, Norway and the Czech Republic should invest in sustaining high gas production and export pipelines utilisation.

→ Norway and the Czech Republic should allow further exploration of the possibility of greater gas supply to the EU via increased investments in greenfield offshore pipelines and production on the Norwegian Continental Shelf.

→ In the long-term, both countries should jointly work on developing the hydrogen market, including production from RES in Norway and transportation further to EU MS.